Call Tracking For Finance Services

Financial services, understanding where your leads come from and how to convert them is crucial. Call tracking for financial services empowers businesses with real-time insights into their marketing campaigns, helping you optimize efforts, build stronger client relationships, and maximize ROI. Whether you offer loans, insurance, or investment services, this tool is tailored to meet your specific needs.

For the finance industry, where trust and personalized interactions are paramount, call tracking provides invaluable insights into customer behavior and campaign effectiveness.

Why Financial Services Need Call Tracking ?

Boost Client Retention

Understanding the nature of customer calls helps institutions tailor their services, fostering trust and long-term relationships.

Enhance Marketing ROI

Call tracking helps financial institutions identify top-performing campaigns, optimizing budget allocation for better marketing ROI.

Lead Attribution

By tracking calls back to their source, financial firms can pinpoint the exact keywords, ads, or platforms that are driving quality leads.

Improve Customer Experience

Analyzing call recordings helps train staff to provide personalized service, boosting customer satisfaction in finance.

Marketing Challenges Faced by Financial Services Companies

Building Trust in a Competitive Market

Financial services rely heavily on customer trust, but establishing credibility in a crowded and competitive industry is challenging. Companies must continuously demonstrate reliability and transparency to win over potential clients.Navigating Strict Regulatory Compliance

Adhering to complex financial marketing regulations can limit creativity in advertising campaigns. Ensuring compliance while still delivering impactful and engaging marketing content is a significant hurdle.Attracting and Retaining the Right Audience

Reaching high-value clients who need tailored financial solutions can be difficult. Identifying and targeting the right audience segments while retaining existing clients requires precision and consistency in messaging.Adapting to Digital Transformation

The rapid evolution of digital platforms and technologies demands that financial services stay ahead in online marketing. Struggling to keep up with trends like SEO, social media engagement, and mobile optimization can limit visibility.Measuring Marketing ROI Effectively

Quantifying the success of campaigns and understanding which channels drive the most leads or conversions can be complicated. Without robust analytics tools, tracking and optimizing marketing investments becomes an ongoing challenge.

How Call Tracking Solves Challenges Faced by Financial Services

With the complexity of financial products, clients often require thorough and personalized discussions before committing to significant decisions. This highlights the need for an efficient system to manage, analyze, and optimize these interactions. Call tracking plays a pivotal role in ensuring that every client call is not just managed effectively but also leveraged as a tool to drive business growth and success. Here’s how it helps:

Monitor Campaign Performance to Optimize Marketing Spend

Call tracking software provides detailed insights into your marketing campaigns, showing which channels and strategies are generating the most calls and conversions. By identifying high-performing campaigns, you can allocate your budget more effectively and eliminate spending on underperforming channels. This ensures that every dollar invested in your marketing efforts delivers measurable returns.Understand Client Preferences to Offer Tailored Solutions

Each client has unique financial needs, whether they are seeking loans, insurance policies, or investment advice. Call tracking software captures valuable data from phone interactions, such as frequently asked questions, common concerns, and recurring patterns. This data helps you better understand client preferences and pain points, enabling you to craft personalized solutions that resonate with their specific requirements.Build Stronger Client Relationships Through Seamless Communication

Effective communication is the cornerstone of trust in the financial industry. Call tracking software ensures calls are routed to the most appropriate agent based on the client’s needs, location, or the nature of their inquiry. Additionally, features like call recording and analytics help you refine your communication strategies by understanding what works best for your clients. This level of responsiveness and attention to detail fosters stronger, more meaningful relationships with your clients, enhancing their overall experience.

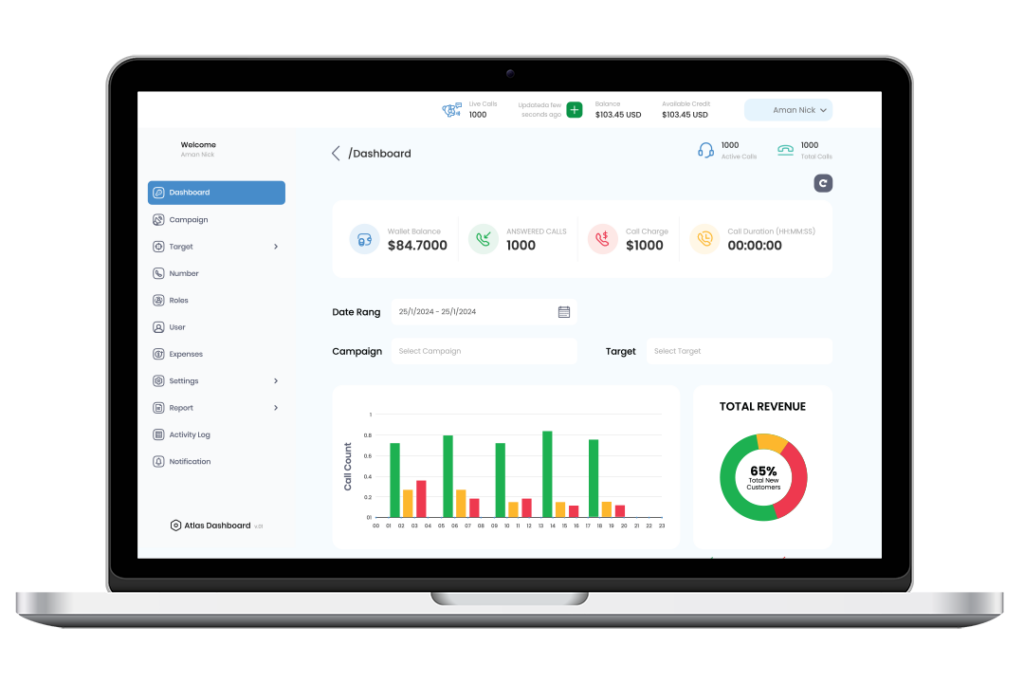

Atlas’ intuitive and robust dashboard is a game-changer for the finance industry, offering real-time insights and comprehensive analytics to enhance your business operations. Designed to simplify complex data, the dashboard enables financial professionals to track marketing performance, optimize lead generation, and improve client communication seamlessly. With easy access to call attribution, campaign metrics, and team productivity insights, you can make data-driven decisions to allocate budgets effectively and deliver personalized client experiences. Whether managing loans, insurance, or investment services, Atlas’ dashboard ensures you stay ahead in a highly competitive market.

Atlas’ expense tracking feature is tailored for the finance industry, enabling businesses to monitor and manage their marketing spend with precision. This powerful tool provides real-time insights into budget allocation, campaign costs, and ROI, ensuring every dollar spent contributes to measurable growth. By identifying high-performing campaigns and minimizing wasted expenses, financial professionals can optimize their marketing strategies while maintaining cost efficiency. Whether you’re managing advertising budgets for loans, insurance, or investment services, Atlas’ expense tracking feature empowers you to make smarter financial decisions and drive sustainable success.

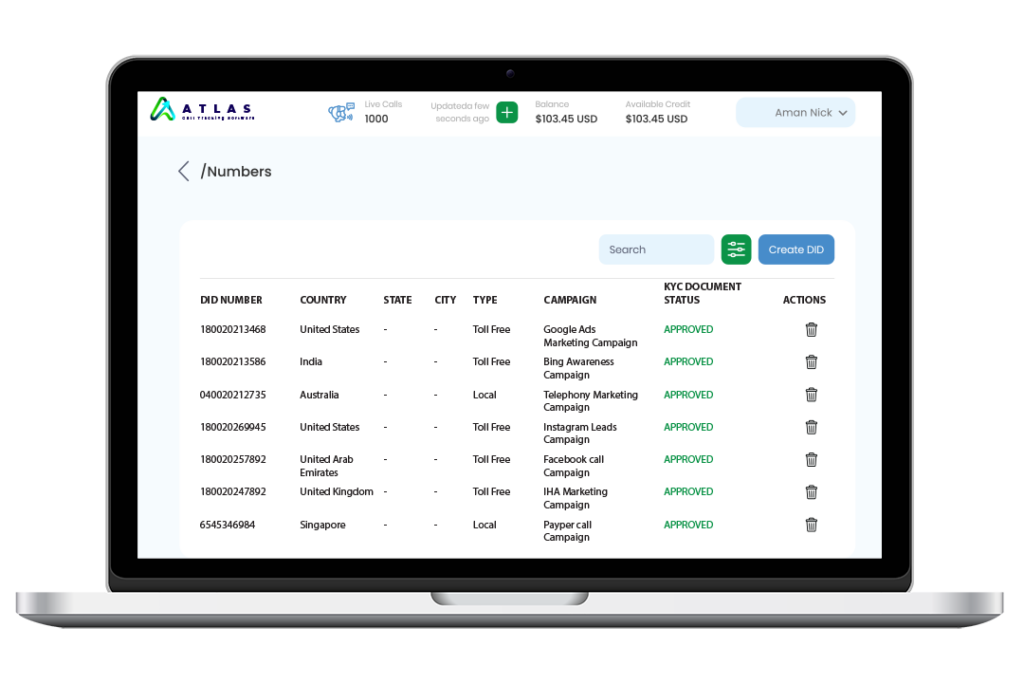

Atlas’ unique number management feature revolutionizes the way financial services track and analyze client interactions. By assigning distinct phone numbers to individual campaigns, ads, or channels, businesses can accurately attribute calls to their respective sources. This granular visibility helps financial professionals understand which marketing efforts are driving the most engagement and conversions. Whether you’re promoting loan products, insurance policies, or investment services, unique number management ensures precise tracking, reduces overlaps, and provides actionable insights to optimize marketing performance and client outreach.

Get Your $100 Free Credit on Sign-Up

Discover how Atlas can transform your financial services business. Start optimizing your leads with CallAtlas today!

Frequently Asked Questions

Atlas enables financial businesses to monitor, manage, and analyze incoming calls. It helps optimize marketing campaigns, improve customer interactions, and track ROI by linking calls to specific ads, keywords, and sources.

It allows financial institutions to analyze call data, understand customer intent, and identify high-quality leads. This helps target the right audience and personalize communication strategies for better results

SmartLine Tracker is a feature that provides unique numbers for various campaigns or channels. This ensures accurate tracking of calls back to their sources, enabling financial companies to evaluate the performance of different marketing efforts.

Expense tracking in call tracking software helps businesses manage their marketing budgets effectively by identifying underperforming campaigns and reallocating resources to more profitable initiatives.

Yes, call tracking software is designed with robust security measures to ensure data privacy and compliance. It protects sensitive client information, making it suitable for finance-related communications.